Real Estate Sector

SEDCO Capital REIT

ETHICAL AND SHARIAH-COMPLIANT INVESTING

The SEDCO Capital REIT is a closed-end Shariah-compliant fund whose objective is to provide regular income, with the potential for capital appreciation, by investing in income-generating real estate in Saudi Arabia. The fund size is SAR 600 million and it distributes no less than 90% of its net profits. The Fund’s assets are located throughout Jeddah, Riyadh, and Eastern Province, and comprise the office, retail, residential, entertainment, and hospitality segments.

SEDCO Capital is a global Shariah-compliant and ethically led asset management and investment advisory firm. The Firm was founded in 2009 with roots dating back to 1976 and today has a strong reputation for providing world-class investment solutions to high net worth individuals (HNWIs), family offices, institutions, and endowment funds.

With a highly dedicated and seasoned team of professionals working from Riyadh, Jeddah, London, and Dubai, SEDCO Capital offers attractive investment solutions across global markets through carefully engineered public and private funds and special investment tools.

As part of its holistic and dynamic approach to managing client portfolios, the Firm invests across its actively managed assets within global Private Markets such as Private Equity, Real Estate, Infrastructure and Leasing, in addition to Public Markets including local, regional and international Public Equities and Fixed Income. It also offers third party funds through its Luxembourg platform.

As of December 31, 2019, SEDCO Capital oversees $5.2 billion total assets under management (AUM).

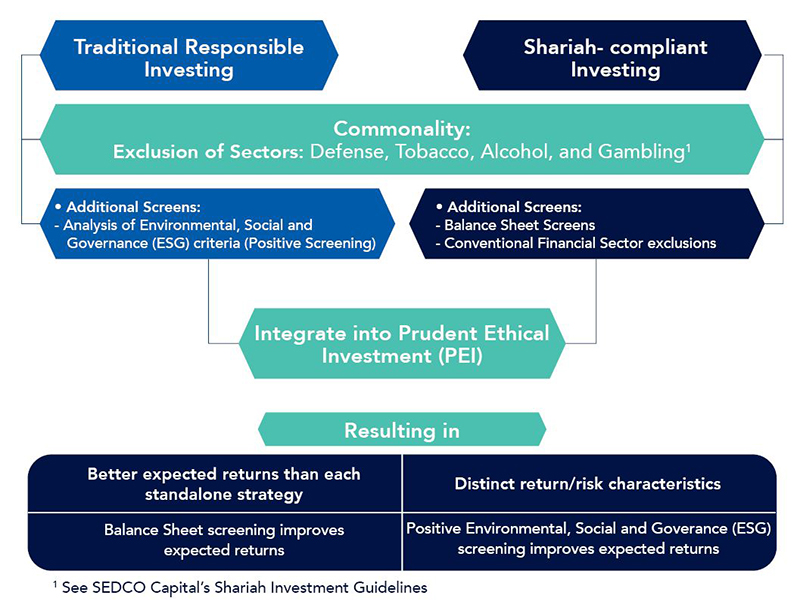

SEDCO Capital pioneered a world-class investment approach known as Prudent Ethical Investment (PEI). It combines the best of Shariah-compliance with ethical investing to deliver exceptional performance while minimizing downside risks.

Moreover, the firm takes great pride in being the first Shariah-compliant Saudi Arabian firm to sign the United Nations Principles for Responsible Investment (UNPRI).

In UNPRI’s annual assessment, the company scored A+, the highest score in most categories, including Strategy & Governance, Active Management, and Engagement in Relation to Private Equity.

SEDCO Capital oversees approximately SAR 20 billion

Through its investments in Saudi real estate, fixed income securities, and Saudi equites, SEDCO Capital has been a key contributor to the growth of the Saudi Arabian private sector.

In support of Saudi Vision 2030, SEDCO Capital will continue to deploy investments across key sectors including entertainment, infrastructure, and technology.

SEDCO Capital has also been actively involved in several high-profile industry events in the Kingdom. For example, in 2019, it sponsored the Financial Sector Conference in Riyadh. It also hosted the Fifth International Executive Program in Islamic Finance for King Abdulaziz University in Jeddah.

SEDCO Capital has been recognized by its peers and the Shariah-compliant investments community as an industry leader. In 2019 and 2020, it won the Market Leadership Award for Asset Management at the Global Islamic Finance Awards, and it won Best Asset Manager Award at the Islamic Business and Finance Awards in 2019.

SEDCO Capital pioneered an investment approach, named Prudent Ethical Investment (PEI), that integrates the global shift toward responsible investing with Shariah-compliant investing.

A common denominator between traditional responsible investment and Shariah-compliant investment is the exclusion of non-permissible sectors.

Shariah-compliance requires the additional screening of balance sheet ratios such as leverage, cash and interest-bearing securities, and/or accounts receivable to market cap or total assets (whichever is greater). SEDCO Capital’s research has shown that applying such balance sheet screening criteria can indeed enable Shariah-compliant investors to improve their risk-adjusted returns over those of conventional and traditional responsible investment portfolios.

For SEDCO Capital, being a prudent investor means avoiding undue risks while seeking sustainable investments in companies that exemplify strong governance. PEI ensures there is full clarity around the underlying risks, leverage structure, and cash flows of any investment.

Lower financial leverage and better cash conversion result in a bias towards quality and growth, thereby underscoring the significance of the ‘prudence’ element in the PEI approach.

Moreover, PEI applies an overlay of best practice environmental, social and corporate governance (ESG) criteria to the overall assessment process.

ESG criteria are also used to assess non-financial information and other unconventional risk factors.

Bringing it all together, SEDCO Capital believes its PEI approach can deliver distinctive risk/return characteristics relative to purely conventional or responsible investment strategies. The Firm views its pioneering approach as an incremental yet significant evolution toward ethical investment.

Lower financial leverage and better cash conversion result in a bias toward quality and growth, thereby underscoring the significance of the ‘prudence’ element in the PEI approach.

Moreover, PEI applies an overlay of best practice Environmental, Social and Corporate Governance (ESG) criteria to the overall assessment process.

ESG criteria are also used to assess non-financial information and other unconventional risk factors.

Bringing it all together, SEDCO Capital believes its PEI approach can deliver distinctive risk/return characteristics relative to purely conventional or responsible investment strategies. The firm views its pioneering approach as an incremental yet significant evolution towards ethical investment.