Real Estate Sector

Jadwa REIT Saudi Fund

ESTATE MANAGEMENT

Jadwa REIT Saudi Fund

- www.reit.jadwa.com

- Year fund founded: 2017

- Number of employees: 116

- Fund size: SAR 2.21 billion

Real estate plays an essential role in the Saudi Arabian economy and real estate investment trusts (REITs) are becoming increasingly popular with investors; they are less risky than equities and are considered a good long-term investment, as they typically generate income and distribute dividends.

Jadwa REIT Saudi Fund is a closed-ended real estate investment traded fund that invests primarily in real estate assets located in the Kingdom’s main cities, while ensuring exposure to a diversified range of asset classes. The REIT operates in accordance with Real Estate Investment Funds Regulations and REIT Funds Instructions issued by the Capital Market Authority (CMA). Jadwa REIT Saudi is listed on the Saudi Exchange and is also included in the FTSE EPRA/NAREIT Emerging Index and MSCI Global Small Cap Index.

The primary objective of Jadwa REIT Saudi is to provide its investors with a regular income by investing in income-generating real estate assets. During 2019, Jadwa REIT Saudi acquired three new assets with an average yield of 9.7%, and made an accretive investment toward the end of 2020 in a private real estate investment fund that is expected to yield an average annual return of 10%. While this kind of performance is contributing to a growing awareness among investors of the potential of REITs as good long-term investments, the challenge will be to continue to identify good quality assets for investment.

Jadwa REIT Saudi Fund leverages the power of technology. It has a platform that shows all the fund’s assets and where they are located, and it is exploring the use of artificial intelligence, as it is clear that this technology will significantly change the future of real estate investment. The ability to collect, analyze, and learn from a huge inflow of data promises to make agents more efficient and effective, brokers more strategic, and clients ultimately empowered to experience the buying and selling process with much less uncertainty.

1-REIT sector

Real estate investment trusts (REIT) are income-generating funds that distribute 90 percent of dividends to the shareholder. In Saudi Arabia, REITs are new phenomena in the investment community that have had a positive effect on the real estate market. Since 2016, 16 REITs have been listed in Saudi Exchange Market. This rapid growth has created more transactions across various sectors, unlocking liquidity for investors and developers in the market to provide better quality assets. Moreover, as a result of the government’s drive to boost private sector participation, local investors have witnessed more transparency on the performance, ownership, and regulation of real estate markets, thereby reflecting positive momentum and attracting foreign capital.

Jadwa REIT Saudi Fund was worth SAR 1.58 billion when it launched

10% Average yield of recently made investment

2-Jadwa’s REIT Saudi achievements

Jadwa REIT Saudi Fund is one of the leading REITs in the REIT sector in Saudi Arabia and was one of the first to distribute quarterly dividends after launching.

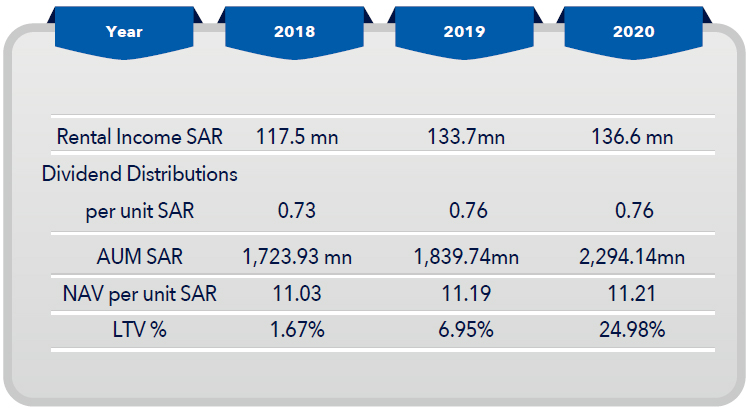

Jadwa Saudi REIT Fund is a diversified fund composed of tenants and assets across various sectors, allowing it to withstand market downturns. Since launch, the fund drew down from its debt facility, making the fund's loan-to-value (LTV) as of today around 24.14 percent, which were used to finance the fund's acquisitions and investments that were made in 2019 and 2020. Impressively increasing the fund's operations per unit from SAR 0.73 to an expected SAR 0.92 per unit.

Jadwa REIT Saudi focuses on working with leasing-to-investment or blue-chip tenants such as Muhadib Group, Worley Parson, and Al Maarefah University.

Since the addition of Jadwa REIT in FTSE EPRA/NEREIT emerging market and MSCI Global Small Cap Indices, it has witnessed an increase in foreign capital.

3- What differentiates Saudi REIT from the competition?

Jadwa Saudi REIT Fund offers a diversified exposure to different real estate asset classes, positioning it to withstand market downturns. Saudi REIT trades at a premium price to net asset value (NAV), indicating positive and confident investor sentiment.

4- Key Company Data