FINANCIALS SECTOR

Saudi Re

AN A-CLASS REINSURER

Saudi Re

- www.saudire.net

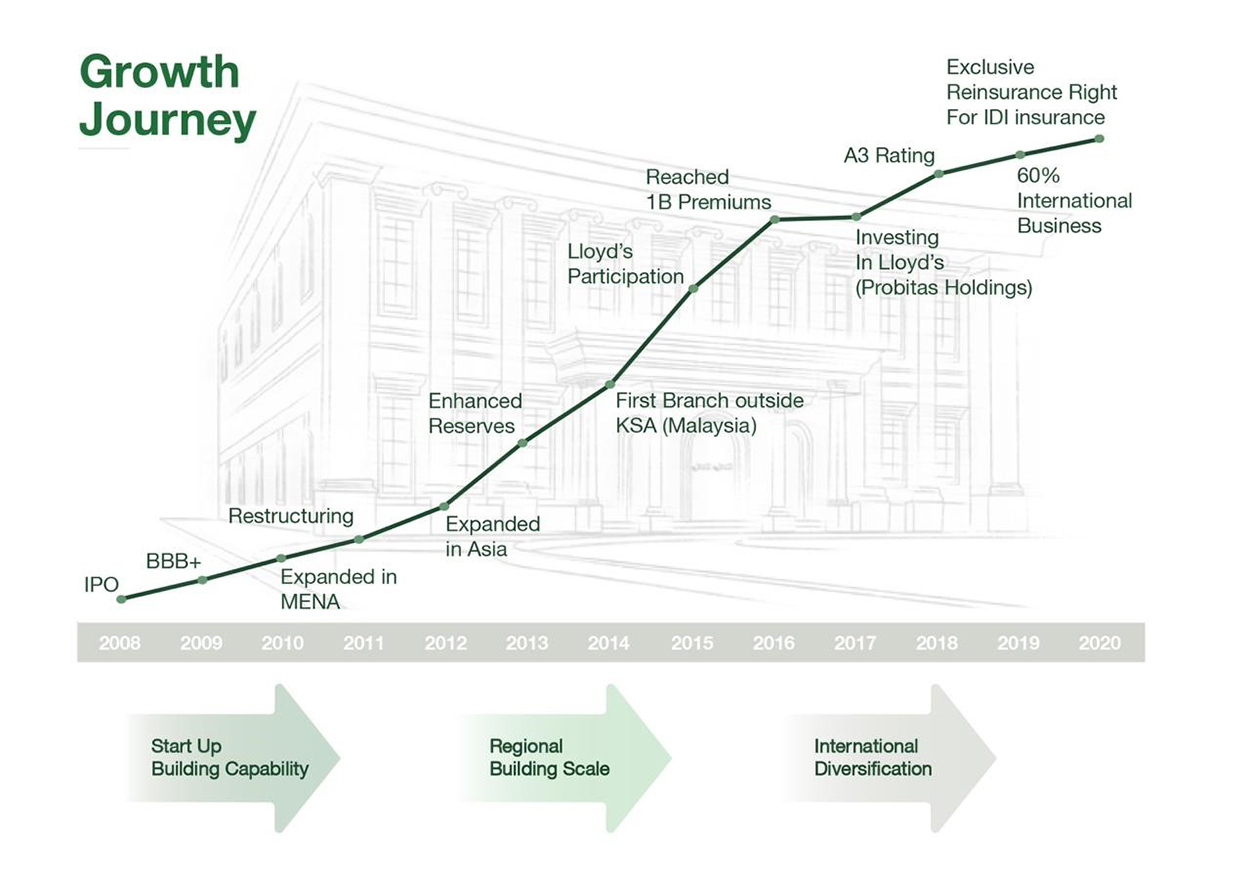

- Year company founded:2008

- Number of employees: 92

- Market capitalization: SAR 1.224 billion

Saudi Re is a full-fledged reinsurance company that specializes in facultative and treaty reinsurance solutions in property, engineering, liability, marine, motor, life, and health lines. Established in 2008, it has a paid-up capital of SAR 891 million ($ 237.6 million) and operates from Riyadh with a branch in Malaysia.

The Kingdom’s Sole Reinsurer

Saudi Re was established in 2008 as the first specialised licensed reinsurance company in the Kingdom, taking advantage of its presence in a G20 economy and one of the world’s highest growth insurance markets. The company underwrites facultative and treaty risks on a proportional and nonproportional basis. Saudi Re focuses on key lines of business including property, engineering, liability, marine, motor, life, and health.

Being the only specialized reinsurer in the Kingdom provides a competitive advantage for Saudi Re, which offers opportunities for growth and development. Saudi Re has capitalized on this domestic advantage in building a strong entity, which has served as stepping stone for expansion to global markets.

Saudi Re is rated A3 with a stable outlook by the credit rating agency Moody’s and AA+ by its Saudi equivalent, Tassnief. These excellent ratings reflect Saudi Re’s strong brand and market position in Saudi Arabia as well as a growing presence in its target markets of Asia, Africa and Lloyd’s. In addition, the ratings highlight the strong asset quality, good capital adequacy, and debt-free capital structure.

Saudi Re capitalizes on the advantageous position of being the only licensed reinsurer in the Kingdom, a progressive G20 economy with high potential for (re insurance and risk-transfer solutions. As a domestic reinsurer, Saudi Re benefits from the local retention regulations and exemption from withholding tax. This was reaffirmed by assigning Saudi Re the exclusive reinsurer of the newly mandated inherent defects insurance program, which applies to all private construction projects.

International Presence in + 40Markets, Representing 63% of Saudi Re Portfolio

Beyond the home market, Saudi Re has established a strong foothold in the international reinsurance market, driven by growth and diversification objectives. in 2020, international business represented 63%percent of the company’s portfolio, coming from more than 40 markets across the Middle East, Asia, Africa, and Lloyd’s of London in the UK.

In addition, since 2017, Saudi Re has held 49.9 percent of the shares of Probitas Holdings (Bermuda) Limited, which owns Probitas 1492, a syndicate at Lloyd’s of London specialising in property, construction, and casualty (re)insurance solutions. Probitas 1492 writes business across the UK and Europe, the Middle East and Africa, Asia, Latin America, and Canada, with a focus on high-growth markets,

Integrating ESG

Saudi Re is the first company in the Saudi insurance market to issue a sustainability report based on UN SDG’s. Saudi Re sustainability framework builds on six pillars: national contribution, strong governance and economic performance, responsible customer relations, environmental protection, sustainable insurance, and community care.

Clear Growth and Diversification Strategy

Saudi Re strategy evolves around five strategic pillars:

- Achieve an economically-scaled book of business that is resilient against large/cat losses, absorbs operational expenditure and generate investment income.

- Maintain a well-balanced reinsurance portfolio with spread geographical presence and diversified lines of business resulting in sustainable technical earnings and controlled concentration and accumulation risks.

- Foster solid and long-term relations with clients, brokers and partners based on mutual benefits and aligned interest.

- Build and acquire competent technical, analytical, operational, technological, financial and human capabilities to serve the stakeholders

- Achieve financial soundness that is translated to a solid capitalization, optimized solvency and technical reserves, diversified streams of revenue, and strong credit rating.

Saudi Re’s rapid expansion and noticeable progress were enabled by it’s strong financial position, close client relationship, technical capabilities and its proximity to promising markets.

With as asset base nearing SAR 2.9 billion (USD 773 million) and capital of SAR 891 million (USD 237.6 million), Saudi Re ranks among the strongest reinsurance companies in the Middle East in terms of capital and financial strength.

Vision 2030 provides opportunities for the insurance industry and for Saudi Re. Saudi Re plays a role in the protection of national assets, security against catastrophic events and supporting the non-oil GDP growth through the expansion of its international business.

Looking ahead, a new growth chapter is unfolding for Saudi Re, for which it has prepared a clear strategy capitalising on its accumulated experience and strong competitive position, driven by a strong desire to achieve and maintain shareholders’ interests.