FINANCIALS SECTOR

Saudi National Bank

PROGRESSIVE BANKING

The Saudi National Bank (SNB) is the largest financial institution in Saudi Arabia and a financial powerhouse in the regional banking industry. SNB plays a vital role in supporting economic transformation in Saudi Arabia. It plays a crucial role in advancing the Kingdom’s banking sector and supporting Vision 2030, the national transformation strategy.

Closely aligned with the programs of Vision 2030, SNB also leverages its position as the largest institutional and specialized financier in the Kingdom to support landmark deals and mega projects.

The vision of SNB is to be the premier financial and banking service provider locally and regionally through the achievement of its strategic aspirations: to be number one in revenues, number one in profitability, the leader in customer service, the best digital bank, the employer of choice, and the best Shariah-compliant product and service provider in the world.

SNB’s progress toward achieving these aspirations is reflected in its record annual profit for the eighth consecutive year. The bank's scale, reach, and digital capabilities provide enhanced products and services, matched by an unparalleled customer experience.

SNB’s robust balance sheet, resilient business model, and healthy liquidity position enhance the capability of the bank to compete locally and regionally, and facilitate trade and capital flows between the Kingdom, the region and the world

SNB was formed from the merger of two large Saudi banks; the National Commercial Bank and Samba Financial Group

97.6% Percentage of employees that are Saudis

SNB delivers best-in-class digital solutions as a universal bank, enables home-ownership through residential finance, and fosters medium and small business development. The Bank seeks to be the most trusted partner for top-tier Saudi corporates and institutions to support mega deals and projects of the Kingdom, and to be the biggest provider of Shariah-compliant products for all customer segments.

The Saudi National Bank is a leader in treasury and capital markets. It owns both NCB Capital and Samba Capital & Investment Management, which form the largest asset manager, brokerage, and investment bank in Saudi Arabia. SNB has a strong international presence in the Middle East, South Asia, and Turkey, completing the Bank’s vision to compete regionally and internationally and earn its place among the global leaders in financial services.

SNB is a committed supporter of Saudization, creating many opportunities for young people and achieving record rates of Saudi participation in the workplace. SNB also gives great importance to empowering women in the workplace, with representation throughout the organization including the bank’s leadership and the board. Corporate responsibility is an essential element of SNB’s corporate culture and business philosophy. Its corporate responsibility strategy focuses on empowering individuals and non-profit organizations and supporting community activities.

Bank History

SNB was formed from the merger of two large Saudi banks; the National Commercial Bank and Samba Financial Group.

The National Commercial Bank (NCB) was the first bank to be officially licensed to operate in Saudi Arabia, following a Royal Decree on 26th December 1953, corresponding to 20th of Rabi Al-Thani 1373H, which completed the merger of Saudi Arabia’s largest currency exchange houses at the time.

The bank established its Shariah Board in 1996, then became a joint stock company in 1997. In 1999, the Saudi Government, represented by the Public Investment Fund, owned a majority of the bank's shares, while the remaining shares were held by the General Organization for Social Insurance and a number of Saudi investors.

In 2014, the bank listed 25 percent of its shares in an initial public offering on the Saudi Exchange. The listing marked the start of a new era for the Bank.

Over 68 years, the Bank has maintained its growth and development, mirroring the progress toward modernity and the continuous improvement of the Kingdom. Today, SNB holds the leading position among the Kingdom’s financial institutions, meeting its customers’ needs with outstanding products, services, and innovative solutions. The bank harnesses technology to enhance the customer experience and fulfills Shariah-compliant product and service needs.

Similarly, Samba Financial Group was a leading Saudi banking and financial institution. The first branch of Samba was established in 1955 under Citibank’s name. In 1980, a Royal Decree was issued by which Citibank became the Saudi American Bank, with majority shareholding owned domestically. In 1999, Samba merged with United Saudi Bank creating one of the largest financial institutions in the Middle East. The year 2003 witnessed a remarkable milestone for Samba, as it came under local management, and the business was renamed Samba Financial Group or Samba.

Over the past 40 years, Samba has offered a wide range of banking products and services to retail, corporate, private, and investment clients. The group played a key role in supporting SMEs in Saudi Arabia and offered its banking services to international clients in different regions around the world.

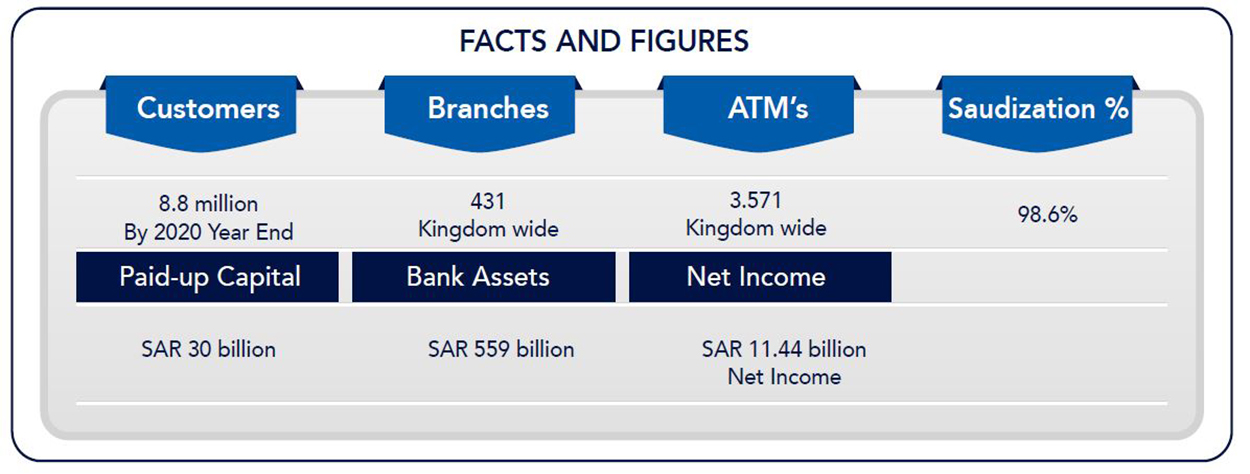

National Commercial Bank Facts and Figures

- www.alahli.com

- Year bank founded: 1953

- Number of employees: 9,334

- Market capitalization: SAR 130.05 billion

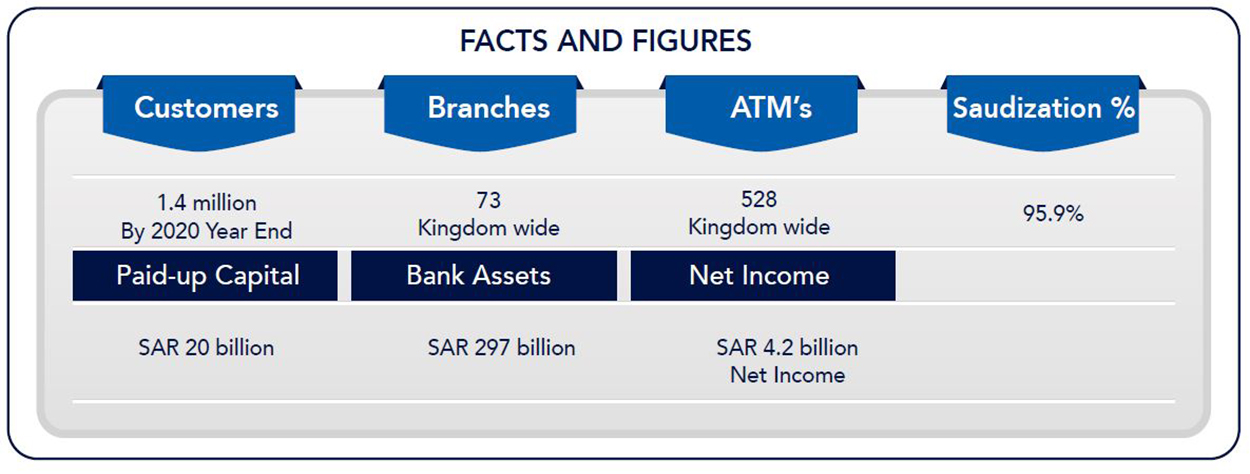

Samba Financial Group Facts and Figures

- www.samba.com

- Year bank founded: 1980

- Number of employees: 3,614

- Market capitalization: SAR 61.10 billion

The Creation of a Giant Banking Entity

On the 1st April 2021, the Saudi National Bank was legally created following the merger of The National Commercial Bank and Samba Financial Group. Riyadh, the capital city of Saudi Arabia, hosts the new headquarters of the Saudi National Bank.