FINANCIALS SECTOR

SABB

LEADING TOGETHER

SABB

- www.sabb.com

- Year company founded:1978

- Number of employees: 4,156

- Market capitalization: SAR 50.8 billion

SABB is at the forefront of corporate and institutional international banking in Saudi Arabia, with a leading retail banking and wealth management proposition. It is also a primary player in trade finance, foreign exchange, equity, and debt wholesale banking and advisory. SABB and Alawwal bank legally completed their merger in 2019, which was the first banking merger in Saudi Arabia for a generation, and the integration concluded in early 2021.

David Dew

Managing Director, SABB

David Dew, Managing Director of SABB until May 2021, said, “As the leading international bank in the Kingdom, we continuously strive to give our customers the highest quality service delivered through digital and personalized services. Our combined local and international best practices allow us to provide an unmatchable experience.”

SABB envisions being a leader in key segments of the financial sector by attracting opportunities to the country. It is a leading trade and corporate bank with strong market shares across its retail and corporate businesses. Thinking about SABB’s success and future outlook, Dew commented, “We are strategically well positioned to contribute and benefit from the national transformation of Vision 2030.”

The bank has backed many new Saudi projects while also supporting the privatization sector. In conjunction with Vision 2030, SABB has a clear focus to enhance local employment opportunities for citizens, women, individuals with disabilities, and the youth by offering the best training and development programs to improve labor participation.

SABB is a dynamic and advanced bank rolling out mobile technologies to provide convenient and seamless services to customers.

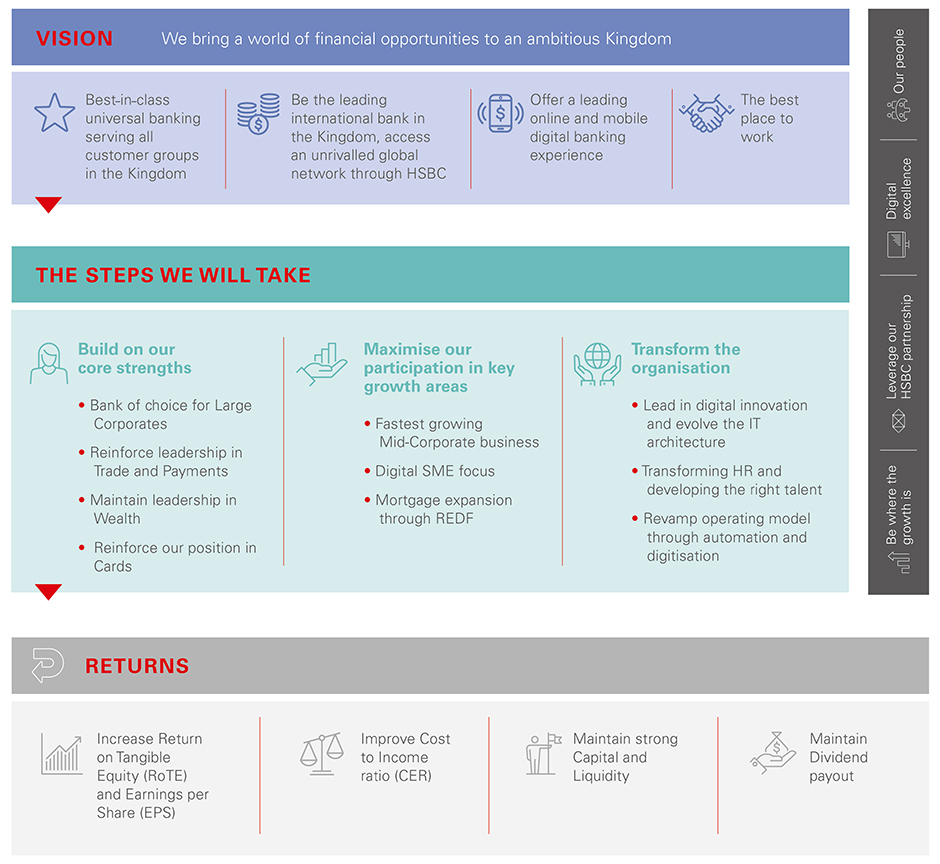

SABB developed its new strategy during 2020 which looks to maximize synergies following its merger with Alawwal bank while improving its performance metrics through focusing on its historic strengths and participating more in key growth areas and aligning to the sectors that are critical to Vision 2030. Innovation and digitization are core elements of the bank’s strategy, and it continues to prioritize enhancing its digital banking services. Thinking about wider change in the sector, Dew said, “Our customers’ banking needs are rapidly changing as technology continues to evolve the sector. Therefore, accelerating our digital transformation plan to offer a wider variety of simplified and digitized services remains a key focus of ours.”

Achievements that the bank has delivered in the tech space include the rollout of SABB’s new top-rated mobile app and the use of blockchain in e-remittance services. It has also become the first bank in the MENA region to offer SWIFT gpi services for transparent payments, which help to dramatically improve cross-border payments and therefore enabling further expansion potential for SABB.

SABB’s new incoming Managing Director, Tony Cripps also notes the importance of ESG and how central it is to the bank’s plans. Cripps commented, “It’s a major part of our strategy. It's key to achieving the merged bank’s ambition. We have already done quite a lot of work in the ‘CSR’ space and this is leveraging beyond that to be involved in communities, to look at the impacts of climate change, the transition risks, and how to help clients with that journey. We want to lead in ESG.”

SABB is the leading international bank in Saudi Arabia, providing Shariah-approved products as well as a wide range of conventional banking products and services for its retail, corporate and institutional customers. Its strategic partnership with HSBC, one of the world’s leading financial institutions, helps to position the company as a preferred banking option.

In 2019, SABB completed a legal merger with Alawwal Bank with the integration concluding in early 2021 – SABB is now one bank, with one culture, one branch network and one IT system. Its greater scale, enhanced market share and efficient operating platform have not only reinforced its commercial position but also provide it with greater opportunities to support the national transformation program - Vision 2030. This aims to ensure that economic development is underpinned by an effective financial sector that can help the country diversify its sources of income and stimulate savings and investment.

Throughout the integration of the two banks there has been a focus on ‘business-as-usual’ operations. SABB maintained its role as the primary settlement bank and custodian for the inflow of foreign direct investment, following the MSCI and FTSE Russell emerging market index upgrades during 2019. It was also the first bank to introduce SWIFTgpi for corporate customers enabling greater transparency in making and tracking payments. And by partnering with global FinTech leaders such as Ripple, it launched online remittance platforms to offer fast, safe, and low-cost payment options for retail customers. SABB’s new mobile banking app also went from strong to stronger with nearly 700,000 downloads during 2020, and top ratings in Apple and Android app stores. SABB also became the first bank in Saudi Arabia to facilitate an overseas trade transaction using Blockchain Technology, as part of an ongoing commitment to improve our banking capabilities for our customers through continuous innovation.

SABB’s governance structure follows best governance practices. The board brings together considerable local and international expertise and included four independent members at the end of 2020. In addition, SABB is recognized as the first Saudi bank to appoint a female chair. The board together with an extremely diverse senior management team have navigated the integration through unchartered territory during 2020, with the global COVID-19 pandemic creating challenges and uncertainty that will remain in our memories for some time to come.

SABB aims to have a positive impact on Saudi society. During 2020, SABB implemented SAMA’s various initiatives to support the private sector and in particular the MSME segment and also supporting retail customers working in the healthcare sector, both through providing payment deferrals. SABB also contributed SAR 27 million across the Ministry of Health’s COVID-19 fund and the Ministry of Human Resources Development Fund.

700,000Mobile banking app downloads

“Accelerating our digital transformation plan to offer a wider variety of simplified and digitized services remains a key focus of ours.”

Together - SABB’s merger with Alawwal Bank

The merger between SABB and Alawwal Bank, is the bringing together two of Saudi Arabia’s best established and most trusted financial institutions, and a milestone moment for the Saudi capital market.

A compelling opportunity

With a larger combined balance sheet, the bank has enhanced scale to serve its diverse customer base and is positioned to be where the growth is. We will play an instrumental role in supporting the Vision 2030 economic transformation program, supporting the financing of infrastructure projects, the development of the capital market, the prioritization of public services and assets, and the creation and building out of new sectors of the economy.

The merger strengthens SABB’s position in retail and SME lending, supporting the expansion of long-term savings, improvement in financial literacy, and the increase in home ownership. With its greater scale, the merged bank will capture new opportunities and existing relationships can be strengthened through increased cross-selling and an enhanced product offering. The combination also creates efficiency gains to enhance returns.

SABB enjoys a unique position in the sector, from partnership with the HSBC banking group through which we provide our customers with a global network of expertise and opportunity.

The value proposition will bolster and accelerate growth by increased capacity applied to investment priorities, such as digital, and the merged bank will offer exciting career opportunities to attract and retain talent. Meanwhile, an unwavering commitment to the quality and diligence of the integration process will ensure that business-as-usual operations continue to operate at the highest standards.

Strategy 2025

During 2020, SABB’s board embarked on a detailed review of the go-forward strategy and the steps that need to be taken. The new strategy will enable SABB to build on its market share, improve financial performance and see a return to top tier performance on key ratios while supporting and benefitting from the Kingdom’s Vision 2030 economic transformation program.